What is Wallester's Life-Changing Potential in 2026?

Discover Wallester s innovative card issuance and payment solutions tailored for businesses of all sizes. Explore seamless integration customizabl

Easy to pay Wallester

Introduction to Wallester

Wallester is a dynamic fintech company that specializes in providing innovative financial solutions, including card issuance and payment processing services. Founded to transform the financial landscape, Wallester combines advanced technology with user-centric design to deliver a suite of products that cater to businesses of all sizes—from startups to large enterprises.

Wallester’s core offerings revolve around its robust card issuance platform, which allows companies to create, manage, and customize both physical and virtual payment cards. These solutions are designed to enhance corporate spending, streamline payment processes, and offer greater control over financial transactions. Whether it’s for employee expenses, customer rewards, or business purchases, Wallester’s card products are crafted to meet diverse needs with high flexibility and security.

Additionally, Wallester is known for its commitment to providing a seamless integration experience. Their platform offers comprehensive APIs, making it easy for businesses to embed Wallester’s functionalities into their existing systems. This, combined with a focus on compliance, fraud prevention, and data security, positions Wallester as a leading choice for companies seeking reliable and scalable financial solutions.

Product Overview

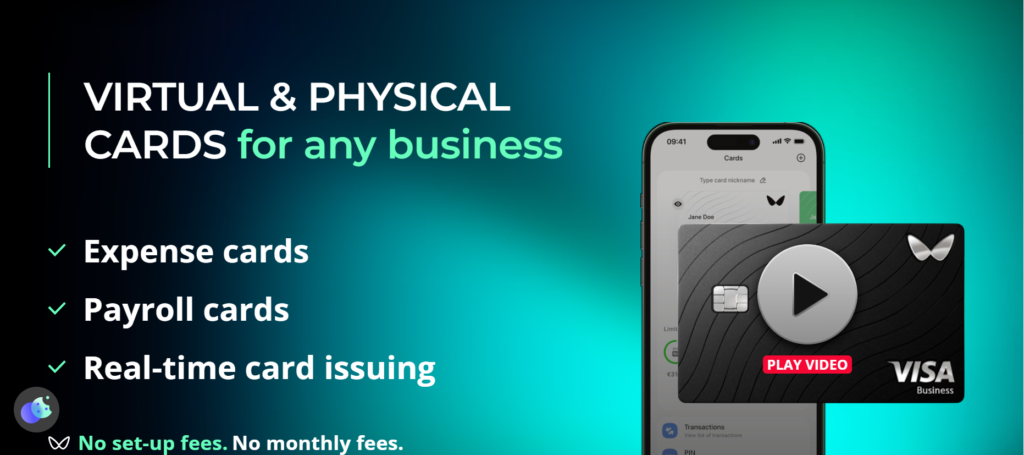

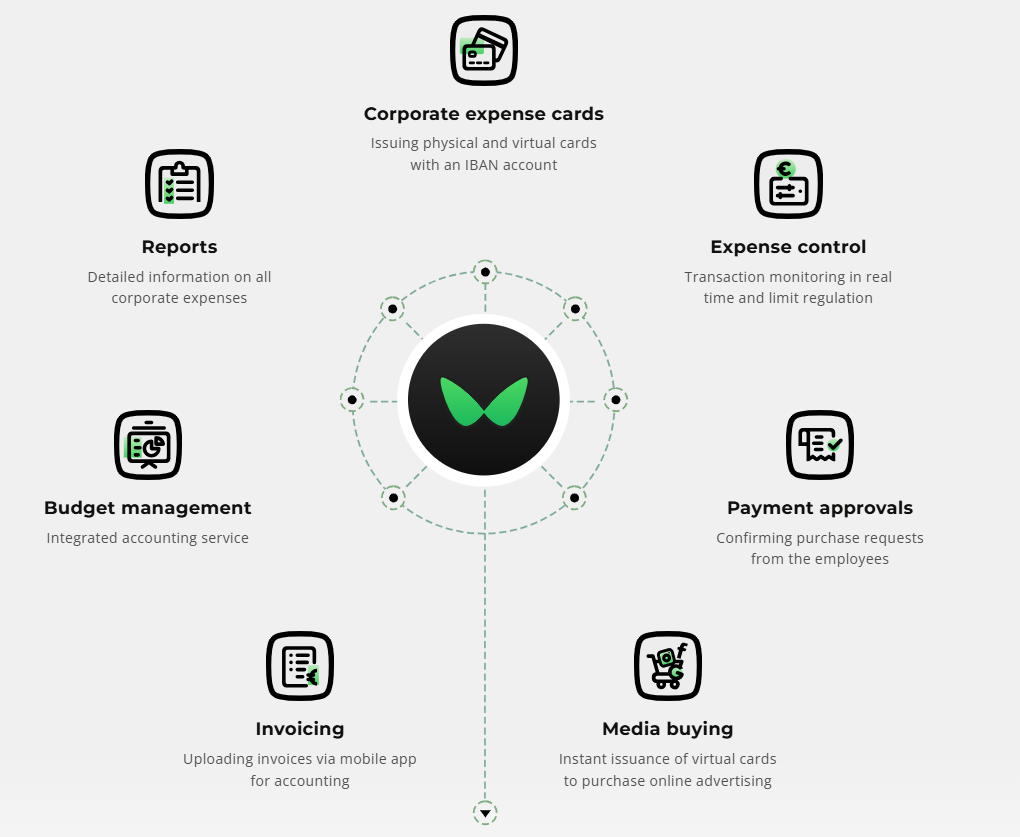

Corporate Cards

- Physical and Virtual Cards: Wallester provides both physical and virtual corporate cards that can be issued instantly. These cards are ideal for managing employee expenses, controlling budgets, and facilitating business transactions.

- Customization: Businesses can fully customize their cards, including branding with logos, colors, and other design elements to match the company’s identity.

- Real-Time Controls: Card limits, spending rules, and transaction tracking can be managed in real-time, offering businesses complete control over their finances.

White-Label Card Issuance

- End-to-End Solution: Wallester’s white-label solution allows companies to issue their own branded cards without the need for extensive financial infrastructure. This is particularly beneficial for fintech startups, banks, and companies looking to enhance their service offerings.

- Flexible Integration: The white-label program includes APIs that simplify integration into existing platforms, enabling businesses to quickly launch their card programs.

- Automated Expense Tracking: Wallester’s platform automates the tracking of expenses, reducing manual paperwork and errors. It also provides detailed analytics and reporting tools to help businesses monitor and optimize spending.

- Seamless Reconciliation: The platform facilitates easy reconciliation of expenses with accounting systems, making financial management more efficient.

Payment Processing Solutions

- Secure and Fast Transactions: Wallester offers reliable payment processing services that support a variety of payment methods, including contactless, chip, and online payments.

- Global Reach: With multi-currency support and international coverage, Wallester’s payment solutions are ideal for businesses operating on a global scale.

Virtual Cards for Online Payments

- Enhanced Security: Virtual cards provide an added layer of security for online transactions, reducing the risk of fraud. These cards can be set with specific limits and expiration dates to further control usage.

- Instant Issuance: Virtual cards can be issued on demand, making them perfect for online purchases, subscriptions, and other digital payments.

- Customizable Rewards: Wallester enables businesses to create tailored reward programs linked to their card offerings, helping to enhance customer loyalty and engagement.

- Flexible Points System: Businesses can set up a points-based system for purchases, which can be redeemed for discounts, cashback, or other rewards.

API and Developer Support

- Comprehensive APIs: Wallester’s API suite allows businesses to fully integrate card issuance and management functionalities into their applications or platforms.

- Developer-Friendly: Detailed documentation, sandbox environments, and technical support ensure a smooth integration process for developers.

Compliance and Security Solutions

- Regulatory Compliance: Wallester ensures all products meet the latest industry standards and regulations, including PSD2, AML, and GDPR, providing businesses with peace of mind regarding legal and compliance matters.

- Advanced Fraud Detection: Sophisticated fraud detection tools are built into Wallester’s platform, utilizing machine learning algorithms to identify and prevent suspicious activities.

Ease of Integration

Comprehensive API Suite

- Extensive API Library: Wallester provides a robust set of RESTful APIs that cover all aspects of card issuance, management, transactions, and reporting. These APIs are well-documented and designed to facilitate smooth communication between Wallester’s platform and a company’s existing software or applications.

- Modular Approach: The APIs are modular, allowing businesses to select and integrate only the functionalities they need. This flexibility makes it possible to scale integration efforts according to the specific requirements of the business.

Developer-Friendly Environment

- Detailed Documentation: Wallester offers comprehensive API documentation, complete with examples and step-by-step guides. This helps developers quickly understand how to implement various features and troubleshoot any issues that arise during the integration process.

- Sandbox Environment: To ensure a smooth transition to live operations, Wallester provides a sandbox environment where developers can test the APIs and simulate real-world scenarios without affecting actual transactions. This testing phase is crucial for ironing out any bugs and ensuring the integration works flawlessly.

- Pre-Built Modules: For businesses looking to minimize development time, Wallester offers pre-built modules and SDKs that can be easily integrated into existing platforms. These plug-and-play solutions significantly reduce the need for custom coding and accelerate the deployment process.

- Drag-and-Drop Interfaces: Wallester’s platform includes user-friendly, drag-and-drop interfaces for certain integration tasks, allowing even non-technical users to configure and manage basic settings without needing in-depth technical knowledge.

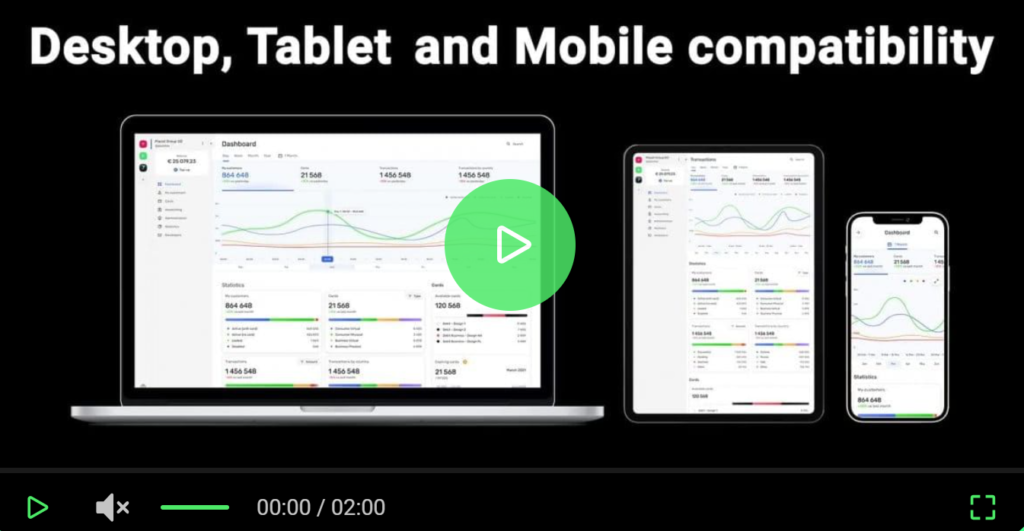

Cross-Platform Compatibility

- Broad Compatibility: Wallester’s solutions are designed to be compatible with a wide range of platforms, including web, mobile, and desktop applications. Whether a business uses cloud-based systems, on-premises software, or a hybrid approach, Wallester’s products are built to integrate smoothly.

- Multi-Language Support: The platform supports multiple programming languages, such as Python, JavaScript, and Ruby, catering to diverse developer preferences and ensuring that integration can be performed using familiar tools and languages.

- Streamlined Onboarding: Wallester’s onboarding process is designed to be as fast and efficient as possible. With clear instructions and dedicated support, businesses can set up their accounts, configure their settings, and begin issuing cards or processing payments in a matter of days.

- Guided Assistance: For businesses that require additional help, Wallester offers guided onboarding assistance, including personalized consultations and step-by-step walkthroughs from integration specialists.

Real-Time Monitoring and Analytics

- Integration Monitoring Tools: Wallester provides real-time monitoring tools that allow businesses to track the performance of their integrations. This includes monitoring API calls, transaction statuses, and error rates, helping businesses maintain optimal performance and quickly identify any issues.

- Data Analytics: Built-in analytics and reporting features offer valuable insights into the usage and effectiveness of integrated Wallester products, enabling businesses to fine-tune their operations and maximize ROI.

Customer Support and Technical Assistance

- Dedicated Support Team: Wallester’s dedicated customer support and technical assistance teams are available to help resolve integration issues promptly. Support is provided through multiple channels, including chat, email, and phone, ensuring businesses have access to the help they need when they need it.

- 24/7 Availability: For businesses operating in different time zones or requiring around-the-clock support, Wallester offers 24/7 assistance to ensure that any technical challenges are addressed without delay.

Pros and Cons of Wallester

Pros

Comprehensive Product Range

- Wallester offers various products, including physical and virtual cards, white-label solutions, and expense management tools, making it a one-stop shop for various financial needs.

Ease of Integration

- With a robust API suite, detailed documentation, and a developer-friendly environment, Wallester ensures smooth integration into existing systems, reducing setup time and costs.

Customization

- Wallester allows extensive customization of cards and payment solutions, including branding options, which helps businesses maintain their brand identity and create personalized user experiences.

- Wallester prioritizes security with advanced fraud detection, data encryption, and compliance with major industry standards such as PSD2, AML, and GDPR, providing peace of mind for businesses and their customers.

Scalability

- Designed to grow with your business, Wallester’s solutions are scalable, supporting multiple currencies and international operations, which is ideal for companies with global ambitions.

Real-Time Management and Analytics

- Wallester’s platform offers real-time controls, monitoring, and analytics, allowing businesses to manage expenses and transactions effectively and make data-driven decisions.

Strong Customer Support

- Wallester provides dedicated customer support with 24/7 availability, multiple communication channels, and guided onboarding assistance to help businesses every step of the way.

- Both physical and virtual cards can be issued instantly, which is particularly beneficial for companies needing immediate access to financial tools for employees or customers.

Cons

Initial Learning Curve

- Despite comprehensive documentation, businesses might experience an initial learning curve when integrating Wallester’s solutions, particularly if they are new to API-based integrations.

Pricing Complexity

- Some users may find Wallester’s pricing structure complex, with various fees potentially adding up depending on the level of customization and services used. Transparent, upfront communication of all costs is crucial to avoid surprises.

Dependency on Internet Connectivity

- As with many cloud-based services, Wallester’s platform requires a stable internet connection for optimal performance. Businesses with unreliable internet may experience disruptions.

Limited Offline Capabilities

- Wallester’s focus on digital and online solutions means there may be limited functionalities for offline transactions, which could be a drawback for businesses that operate in environments with poor internet access.

Market Competition

- The fintech space is highly competitive, and while Wallester offers strong features, some businesses might find similar products from competitors that better fit specific needs or preferences.

Customization Limits for Smaller Businesses

- While customization is a strong point, smaller businesses or those with limited budgets might find that certain advanced customization options are more cost-effective with larger volume commitments.

Potential Overwhelming Options

- The extensive range of features and customization can sometimes be overwhelming for smaller businesses or those not needing a full suite of services. Businesses need to assess their needs to avoid paying for unnecessary features carefully.

Final Verdict: Is Wallester the Right Choice?

The platform’s commitment to security and regulatory compliance adds an extra layer of trust, making it a reliable partner for businesses in the financial space. Additionally, its competitive pricing structure ensures that companies get value for their investment without compromising on quality or innovation.

However, Wallester may not be the perfect fit for every business. Companies that require hyper-specialized features or are deeply invested in certain competing platforms may find some aspects of Wallester limiting. That said, for most businesses seeking a scalable and user-friendly financial management solution, Wallester is a strong contender.

What is Wallester's Life-Changing Potential in 2026?

Discover Wallester s innovative card issuance and payment solutions tailored for businesses of all sizes. Explore seamless integration customizabl